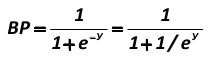

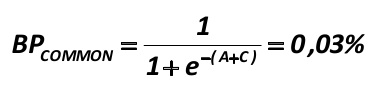

The probability of bank bankruptcy in % Alexander Shemetev

11.jpg:224x62, 4k

|

|

|

The probability of bank bankruptcy in % Alexander Shemetev 11.jpg:224x62, 4k |

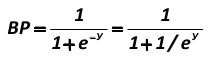

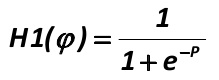

Y – is the power exponent of e, calculated by this formula Alexander Shemetev 12.jpg:534x68, 14k |

|

Tag for web-tipography Alexander Shemetev 123.jpg:28x21, 0k |

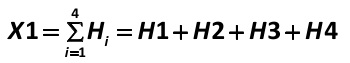

X1 Ratio Alexander Shemetev 13.jpg:350x63, 7k |

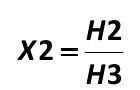

X2 Ratio Alexander Shemetev 14.jpg:140x90, 3k |

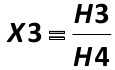

X3 Ratio Alexander Shemetev 15.jpg:115x70, 3k |

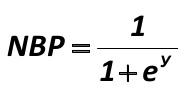

NBP – Non-Bankruptcy Probability is calculated by the formula developed by the author Alexander Shemetev 16.jpg:184x91, 4k |

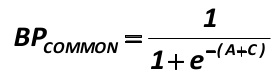

Probability of total bank failure is calculated from a formula developed by the author Alexander Shemetev 17.jpg:276x78, 5k |

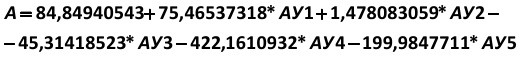

Parameter A is calculated from equation Alexander Shemetev 18.jpg:525x65, 20k |

|

AY1 – is the sum of money (bank’s monetary fund: MFBANK) in the balance of the credit institution to total assets (ABANK) Alexander Shemetev 19.jpg:211x34, 4k |

|

AY2 – is the ratio of equity (bank’s owned capital /equity/: OC(Eq)BANK) to total liabilities of credit institutions (total liabilities of bank: TLBANK) Alexander Shemetev 20.jpg:237x37, 4k |

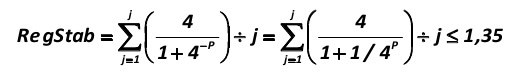

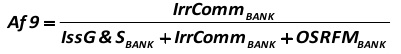

The author analyzed and developed a model that allows us to calculate the aggregate banking sector risky stability in a region, based only on data from banks' balance sheets in the region in the minimal representation Alexander Shemetev 201.jpg:514x72, 12k |

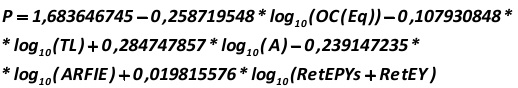

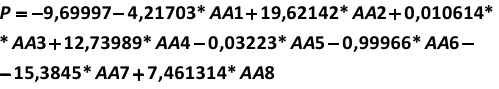

P – is a function calculated from the balance of each bank in the region as follows Alexander Shemetev 202.jpg:518x88, 23k |

|

AY3 – the ratio of total assets’ revaluation funds in equity (ARFIEBANK) to equity (OC(Eq)BANK) (the aggregate value of own sources of credit institution) Alexander Shemetev 21.jpg:270x38, 5k |

|

AY4 – is the sum of retained earnings of the year (RetEYBANK) (from the passive in balance) to the total value of bank’s liabilities (TLBANK) (1.12) Alexander Shemetev 22.jpg:276x41, 5k |

|

AY5 – is the sum of retained earnings from previous years (RetEPYsBANK) (excluding retained earnings this year, which is reflected as a separate line in bank balance) to the total value of assets (ABANK) Alexander Shemetev 23.jpg:288x41, 5k |

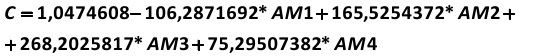

The parameter C is calculated from equation Alexander Shemetev 24.jpg:533x56, 17k |

|

AM1 – is the ratio of the total value of assets (ABANK) to the total value of liabilities of credit institution (TLBANK) Alexander Shemetev 25.jpg:229x38, 4k |

|

AM2 – the ratio of total assets’ revaluation funds in equity (ARFIEBANK) to the total value of liabilities (TLBANK) Alexander Shemetev 26.jpg:251x34, 5k |

|

AM3 – the ratio of equity’s value of credit institutions (OC(Eq)BANK) to the total value of assets (ABANK) Alexander Shemetev 27.jpg:278x40, 5k |

|

AM4 – is the sum of retained profits of the year (RetEYBANK) and past years (RetEPYsBANK) from the passive in balance to the total value of liabilities of credit institutions (TLBANK) Alexander Shemetev 28.jpg:369x35, 6k |

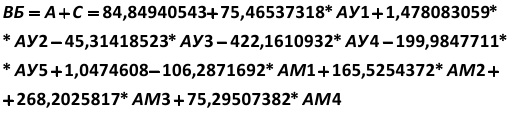

The sum of the coefficients A and C inside the model will clearly identify those banks Alexander Shemetev 29.jpg:515x114, 32k |

The quick to use variant of real quality of bank's equity-capital estimation Alexander Shemetev 30.jpg:219x80, 4k |

Where the exponent-power of regression of equation (1.20) is given by Alexander Shemetev 31.jpg:499x89, 22k |

|

AA1 – the ratio of cash (bank’s monetary fund: MFBANK) to the obligations of the bank (TLBANK) Alexander Shemetev 32.jpg:216x37, 4k |

|

ÀÀ2 – the ratio of equity of bank (OC(Eq)BANK) to total assets of credit institution (ABANK) Alexander Shemetev 33.jpg:255x33, 4k |

|

ÀÀ3 – the ratio of retained earnings of previous years (RetEPYsBANK) to the deposits of individuals (DepIndBANK) Alexander Shemetev 33a.jpg:275x24, 5k |

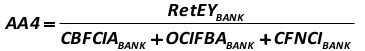

ÀÀ4 – this is the undistributed profits of the year (RetEYBANK) (from the passive in balance) to the sum of: CBRF (Central Bank) funds on the credit institutions’ accounts (CBFCIABANK); other credit institutions’ funds on bank accounts (OCIFBABANK); clients’ funds – who are not credit institutions – within their full amount (CFNCIBANK). Alexander Shemetev 34.jpg:365x51, 8k |

|

ÀÀ5 – is the ratio of the revaluation of fixed assets (total assets’ revaluation funds in equity: ARFIEBANK) to the sum of fixed assets (property, plant and equipment, or main funds) of the credit institution (FABANK) Alexander Shemetev 35.jpg:258x33, 5k |

|

ÀÀ6 – this is the net amount of net loan debt (NLDBANK) to the sum of bank liabilities (TLBANK) Alexander Shemetev 36.jpg:291x46, 5k |

|

ÀÀ7 – the ratio of equity (owned capital) of bank (OC(Eq)BANK) to the sum of liabilities (TLBANK) Alexander Shemetev 37.jpg:284x35, 5k |

|

ÀÀ8 – the ratio of bank assets (ABANK) to its obligations (TLBANK) Alexander Shemetev 38.jpg:224x36, 4k |

Formula suspected bogus bank’s failure is developed by the author and is as follows Alexander Shemetev 39.jpg:380x88, 7k |

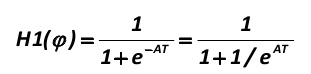

The author’s method of a more profound calculation of the H1 right from the official balance sheet of a credit institution (the balance sheet is enough for this method) Alexander Shemetev 40.jpg:311x74, 6k |

AT – is the total value of the function, which is calculated from the balance sheet using the following formula Alexander Shemetev 41.jpg:515x292, 74k |

|

Af1 – the ratio of equity (owned capital) of the bank (OC(Eq)BANK) to total assets (ABANK) Alexander Shemetev 42.jpg:279x38, 6k |

|

Af2 – the ratio of total assets of the bank (ABANK) to the liabilities’ sum of the credit institution (TLBANK) Alexander Shemetev 43.jpg:238x37, 4k |

|

Af3 – the ratio of total fixed assets’ revaluation (ARFIEBANK) to the total value of liabilities (TLBANK) Alexander Shemetev 44.jpg:272x33, 5k |

|

Af4 – the ratio of fixed assets (PPE) of the bank (FABANK) to liabilities (TLBANK) Alexander Shemetev 45.jpg:238x34, 4k |

|

Af5 – this ratio is the amount of money held by the credit institution on its accounts (bank’s monetary fund: MFBANK) to equity (OC(Eq)BANK) Alexander Shemetev 46.jpg:277x34, 6k |

|

Af6 – the ratio of equity capital of the bank (OC(Eq)BANK) to the sum of liabilities (TLBANK) Alexander Shemetev 47.jpg:271x38, 5k |

|

Af7 – is the ratio of net loan debt (NLDBANK) to the sum of the contributions of individuals (ConIndBANK) Alexander Shemetev 48.jpg:328x35, 6k |

|

Af8 – a ratio of the sum of retained earnings of previous years (RetEPYsBANK) relative to the amount of retained earnings of the year (RetEYBANK) (taken in the liability balance for the same date) Alexander Shemetev 49.jpg:338x35, 6k |

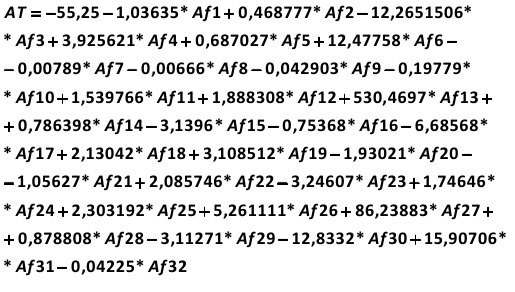

Af9 – the ratio of irrevocable commitments (IrrCommBANK) in relation to the amount of: a credit institution issued guarantees and sureties (IssG&S), plus the sum of irrevocable commitments (IrrCommBANK), plus the sum of shareholders’ (participants’) means of credit organization / own stocks (shares) repurchased from shareholders /members/ (OSRFMBANK) Alexander Shemetev 50.jpg:401x54, 9k |

|

Af10 – the ratio of the contingency fund of the bank /reserve fund of bank/ (RFBBANK) to the sum of the authorized capital /own stocks (shares) repurchased from shareholders /members/ (OSRFMBANK) Alexander Shemetev 51.jpg:365x43, 7k |

|

Af11 – a ratio of the sum of bank’s funds in the Central Bank of Russia (SBFiCBRBANK) to the sum of bank assets (ABANK) Alexander Shemetev 52.jpg:313x42, 6k |

|

Af12 – the ratio of other assets (OtABANK) to the total value of assets (ABANK) Alexander Shemetev 53.jpg:259x34, 5k |

|

Af13 – a ratio of the sum of investments in subsidiaries and associated companies / organizations / (SIS&ABANK) to gross assets ratio (ABANK) Alexander Shemetev 54.jpg:283x37, 5k |

Af14 – a measure, the numerator of which is the sum of retained earnings of previous years (RetEPYsBANK) minus the sum of retained earnings of the year (RetEYBANK) in the denominator is the sum of the bank's liabilities (TLBANK) Alexander Shemetev 55.jpg:336x68, 8k |

|

Af15 – is the amount of required reserves (ARRBANK) in balance assets to the amount of equity (OC(Eq)BANK) Alexander Shemetev 56.jpg:264x27, 4k |

|

Af16 – a ratio of the sum of the fair value of securities available for sale (SFVSASBANK) in relation to the amount of own capital (OC(Eq)BANK) Alexander Shemetev 57.jpg:316x34, 5k |

|

Af17 – is the ratio of reserves for possible losses on credit related commitments (RPLCRCBANK) in relation to the amount of own capital (OC(Eq)BANK) Alexander Shemetev 58.jpg:328x35, 6k |

|

Af18 – the ratio of debt issued by the bank (DIBBANK) to the gross amount of liabilities of credit institutions (TLBANK) Alexander Shemetev 59.jpg:216x29, 4k |

|

Af19 – the ratio of other liabilities (OtLBANK) to assets (ABANK) Alexander Shemetev 60.jpg:228x31, 4k |

|

Af20 – a ratio of the sum of loans, deposits and other funds of the Central Bank of Russia (SLDOFCBRBANK) in relation to the gross amount of the bank's liabilities (TLBANK) Alexander Shemetev 61.jpg:287x34, 5k |

|

Af21 – the ratio of other credit institutions’ funds /let me remind you that the Bank of Russia and its means is not among them/ (/other credit institutions’ funds on bank accounts (OCIFBABANK)/) in relation to customers’ funds (that are not credit institutions) (/clients’ funds – who are not credit institutions – within their full amount (CFNCIBANK)/) Alexander Shemetev 62.jpg:301x34, 6k |

|

Af22 – the ratio of share premium /emission income/ (EIBANK) to the sum of the bank's equity capital (OC(Eq)BANK) Alexander Shemetev 63.jpg:290x37, 5k |

|

Af23 – the ratio of net income of investments in securities and other financial assets available for sale (NIoIiSOFAASBANK) to gross total assets of credit institution (ABANK) Alexander Shemetev 64.jpg:373x41, 7k |

|

Af24 – a ratio of the sum of means a bank holds in other credit institutions (SMBHiOCIBANK) to gross assets (ABANK) Alexander Shemetev 65.jpg:330x34, 6k |

|

Af25 – the ratio of net bank’s investment in securities held to maturity (NBISHMBANK) to total assets (ABANK) Alexander Shemetev 66.jpg:292x36, 5k |

|

Af26 – the ratio of net investments in securities, assessed at fair value through profit or loss (NISAFVTPLBANK) to the gross amount of assets (ABANK) Alexander Shemetev 67.jpg:307x36, 5k |

|

Af27 – a ratio of the sum of bank’s liabilities (TLBANK) to total assets (ABANK) Alexander Shemetev 68.jpg:224x36, 4k |

|

Af28 – the ratio of bank assets (ABANK) to equity (OC(Eq)BANK) Alexander Shemetev 69.jpg:299x36, 6k |

|

Af29 – this is the natural logarithm (ln) of the amount of assets (ABANKA), expressed in thousands of rubles Alexander Shemetev 70.jpg:343x43, 6k |

|

Af30 – this is the natural logarithm (ln) of the amount of bank liabilities (TLBANK), expressed in thousands of rubles Alexander Shemetev 71.jpg:376x45, 7k |

|

Af31 – this is the natural logarithm (ln) of the amount of bank’s own capital (OC(Eq)BANK), expressed in thousands of rubles Alexander Shemetev 72.jpg:382x33, 7k |

|

Af32 – is the cosine (cos) of the size of revaluation of fixed assets’ fund of a bank (ARFIEBANK), expressed in thousands of rubles Alexander Shemetev 73.jpg:305x35, 6k |

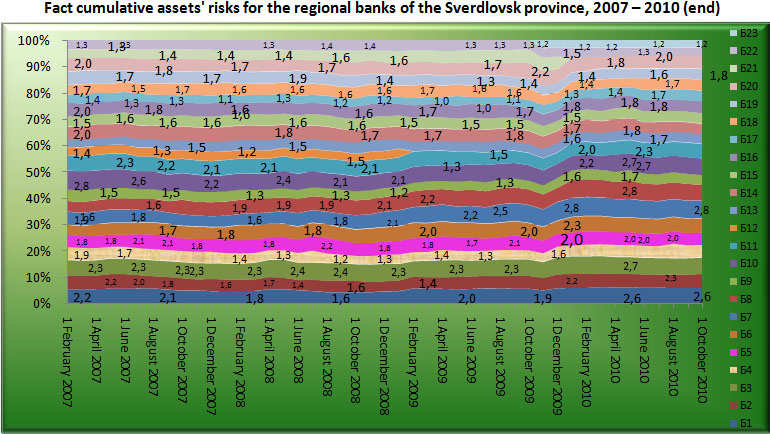

Fact cumulative assets risk for the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev aktiwy.jpg:770x434, 164k |

Alexander Shemetev's photo Alexander Shemetev alexshemetev.jpg:1001x1003, 351k |

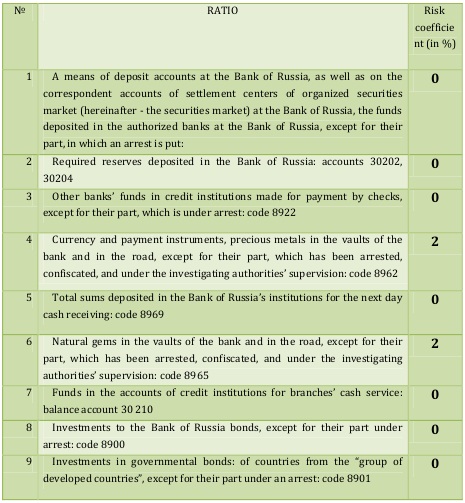

First assets’ group Central Bank of Russia, translated to English by Alexander Shemetev clas1.jpg:465x503, 98k |

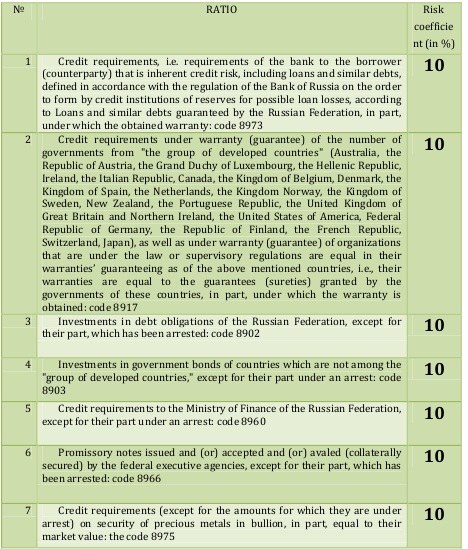

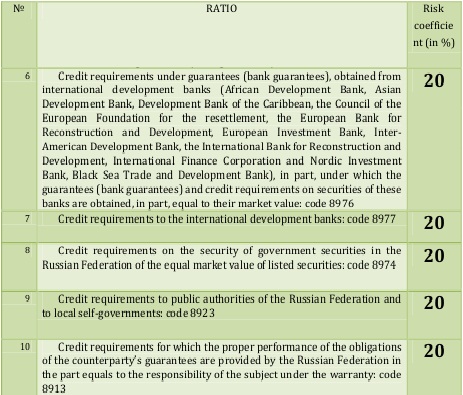

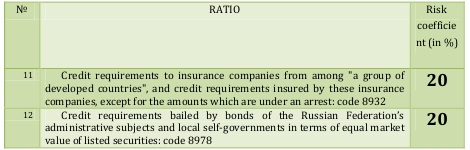

Second group of bank’s assets Central Bank of Russia, translated to English by Alexander Shemetev clas2.jpg:468x549, 130k |

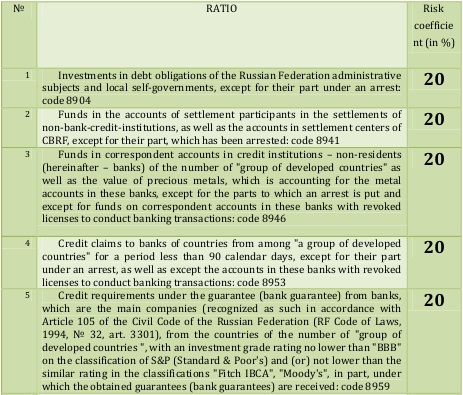

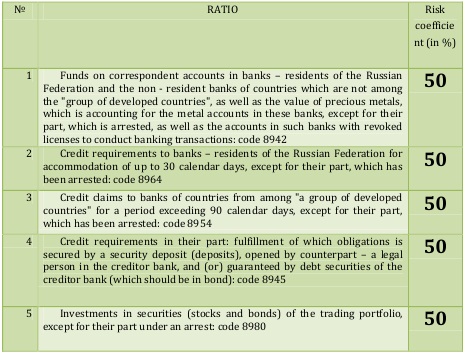

Third group of banks’ assets Central Bank of Russia, translated to English by Alexander Shemetev clas3a.jpg:463x395, 98k |

Third group of banks’ assets Central Bank of Russia, translated to English by Alexander Shemetev clas3b.jpg:463x395, 84k |

Third group of banks’ assets Central Bank of Russia, translated to English by Alexander Shemetev clas3c.jpg:470x150, 30k |

Fourth group of banks’ assets Central Bank of Russia, translated to English by Alexander Shemetev clas4.jpg:466x353, 77k |

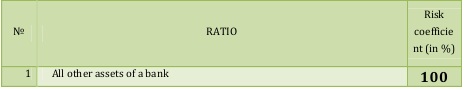

Fifth group of banks’ assets Central Bank of Russia, translated to English by Alexander Shemetev clas5.jpg:467x90, 9k |

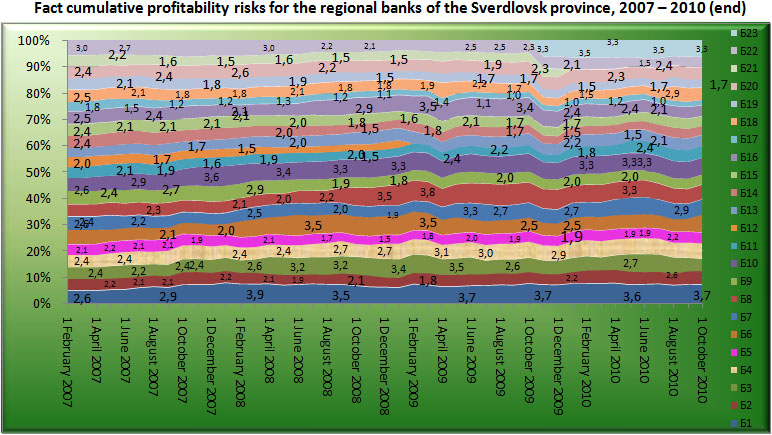

Fact cumulative profitability risk for the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev dohodnostx.jpg:772x435, 168k |

|

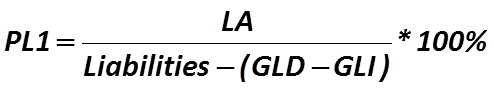

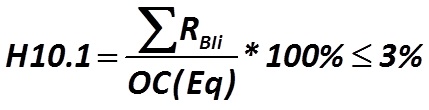

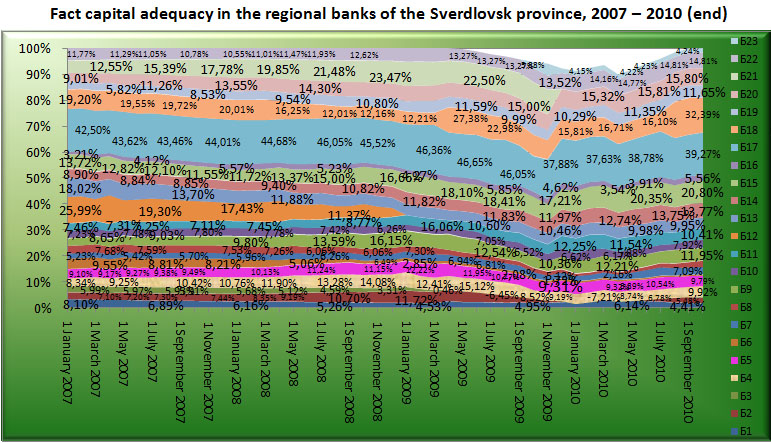

Adequacy of own funds (capital) (H1) is calculated by the formula Central Bank of Russia, translated to English by Alexander Shemetev f11.jpg:540x47, 9k |

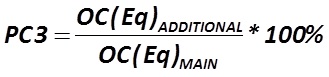

Indicator assessing the quality of capital (PC3) Central Bank of Russia, translated to English by Alexander Shemetev f110.jpg:329x77, 10k |

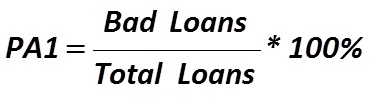

Indicator of the quality of loans Central Bank of Russia, translated to English by Alexander Shemetev f111.jpg:371x104, 11k |

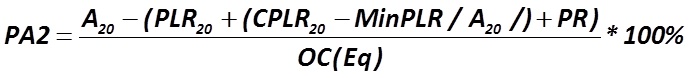

Indicator of risk of loss (PA2) Central Bank of Russia, translated to English by Alexander Shemetev f112.jpg:690x78, 17k |

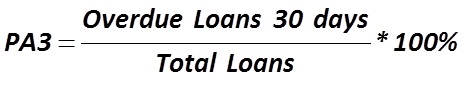

Index of the share of overdue loans (PA3) Central Bank of Russia, translated to English by Alexander Shemetev f113.jpg:464x90, 13k |

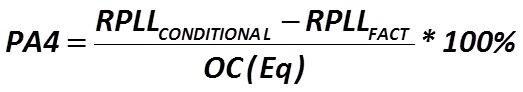

Indicator of the size of reserves for losses on loans and for other assets (PA4) Central Bank of Russia, translated to English by Alexander Shemetev f114.jpg:523x92, 14k |

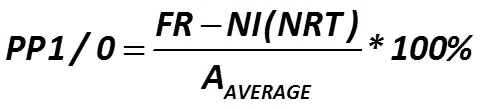

Rate of return on assets PP1/0 Central Bank of Russia, translated to English by Alexander Shemetev f117.jpg:480x109, 14k |

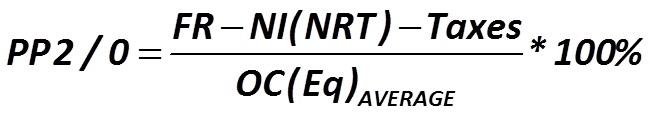

Rate of return on equity (PP2/0) Central Bank of Russia, translated to English by Alexander Shemetev f118.jpg:650x117, 22k |

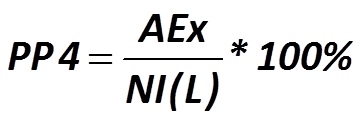

Indicator of the cost structure (PP4) Central Bank of Russia, translated to English by Alexander Shemetev f119.jpg:362x121, 11k |

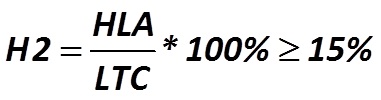

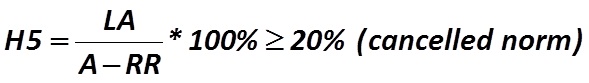

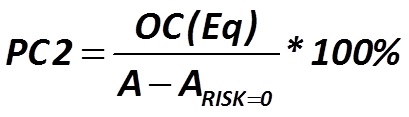

The ratio of instantaneous liquidity Central Bank of Russia, translated to English by Alexander Shemetev f12.jpg:381x100, 11k |

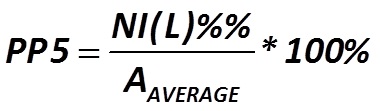

The net interest margin (PP5) Central Bank of Russia, translated to English by Alexander Shemetev f120.jpg:380x111, 13k |

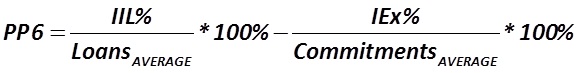

Net spread of the credit operations (PP6) Central Bank of Russia, translated to English by Alexander Shemetev f121.jpg:581x73, 13k |

Indicator of the overall short-term liquidity Central Bank of Russia, translated to English by Alexander Shemetev f123.jpg:494x90, 12k |

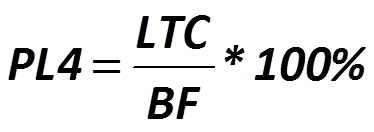

The index structure of borrowed funds (PL4) Central Bank of Russia, translated to English by Alexander Shemetev f124.jpg:374x132, 11k |

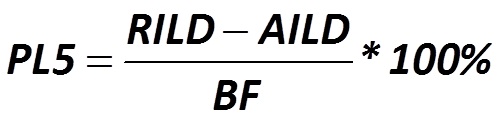

Indicator of depending on the interbank market (PL5) Central Bank of Russia, translated to English by Alexander Shemetev f125.jpg:502x122, 15k |

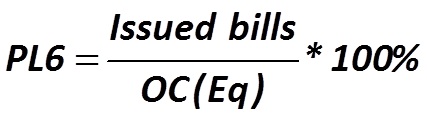

Indicator of risk of the own bill obligations (PL6) Central Bank of Russia, translated to English by Alexander Shemetev f126.jpg:427x120, 14k |

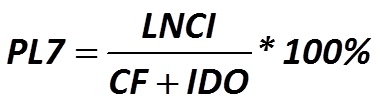

The index of non-bank loans (PL7) Central Bank of Russia, translated to English by Alexander Shemetev f127.jpg:380x105, 11k |

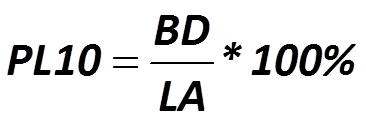

Indicator of risk for large depositors (PL10) Central Bank of Russia, translated to English by Alexander Shemetev f128.jpg:366x124, 11k |

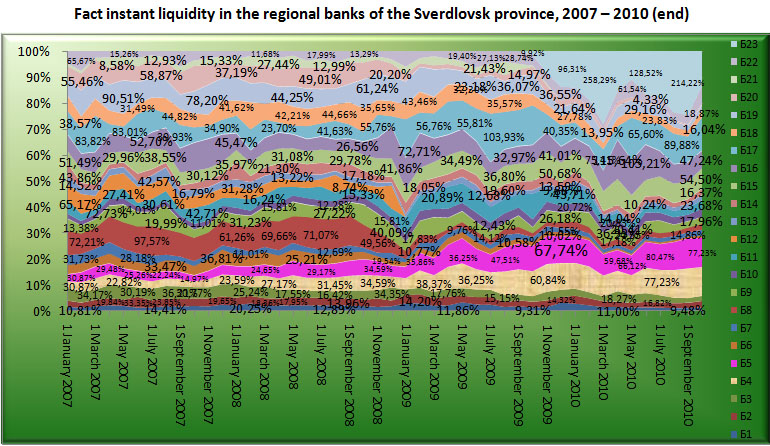

The ratio of the current liquidity Central Bank of Russia, translated to English by Alexander Shemetev f13.jpg:409x106, 11k |

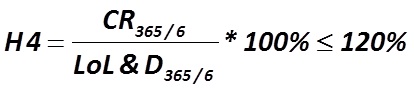

The ratio of the long-term liquidity Central Bank of Russia, translated to English by Alexander Shemetev f14.jpg:414x92, 11k |

The ratio total liquidity Central Bank of Russia, translated to English by Alexander Shemetev f15.jpg:589x83, 15k |

Maximum risk per borrower or group of related borrowers Central Bank of Russia, translated to English by Alexander Shemetev f16.jpg:561x129, 21k |

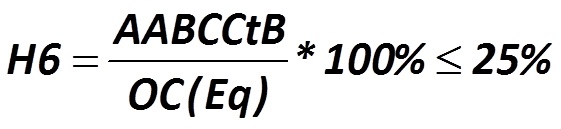

Maximum large credit risk Central Bank of Russia, translated to English by Alexander Shemetev f17.jpg:508x131, 16k |

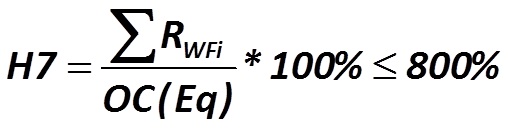

The maximum size of loans, bank guarantees and sureties granted by the bank to its members (shareholders) Central Bank of Russia, translated to English by Alexander Shemetev f18.jpg:454x116, 14k |

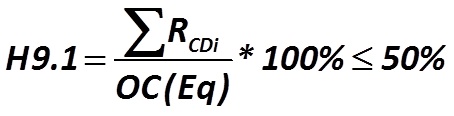

Aggregate risk for the bank's insiders Central Bank of Russia, translated to English by Alexander Shemetev f19.jpg:429x110, 14k |

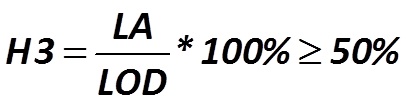

Indicator: the overall capital adequacy ratio Central Bank of Russia, translated to English by Alexander Shemetev f19a.jpg:409x117, 13k |

Fact capital adequacy in the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev faktn1.jpg:771x443, 224k |

Fact instant liquidity of the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev faktn2.jpg:770x446, 227k |

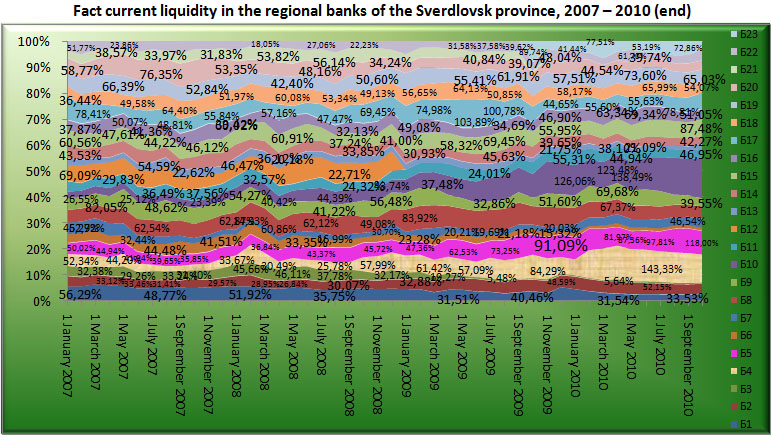

Fact current liquidity of the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev faktn3.jpg:771x437, 223k |

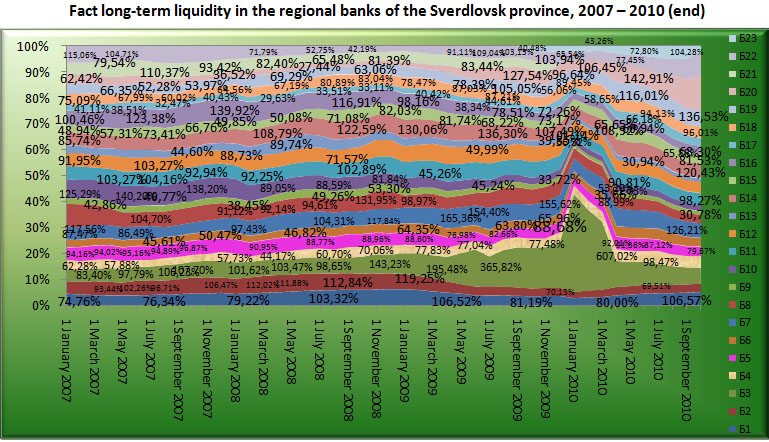

Fact long-term liquidity of the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev faktn4.jpg:769x442, 220k |

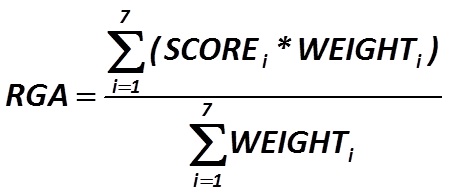

RGA – Ratio General of Assets Central Bank of Russia, translated to English by Alexander Shemetev frga.jpg:450x196, 19k |

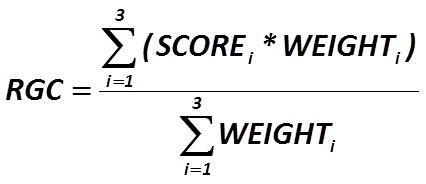

RGC – Ratio General of Capital Central Bank of Russia, translated to English by Alexander Shemetev frgc.jpg:426x184, 16k |

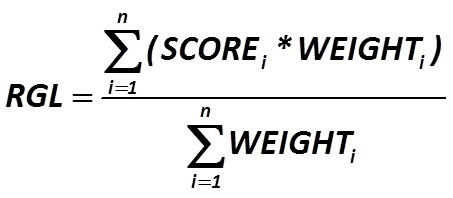

RGL – Ratio General of Liquidity Central Bank of Russia, translated to English by Alexander Shemetev frgl.jpg:453x198, 20k |

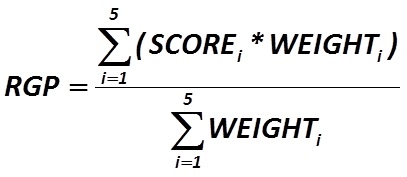

RGP – Ratio General of Profitability Central Bank of Russia, translated to English by Alexander Shemetev frgp.jpg:407x177, 16k |

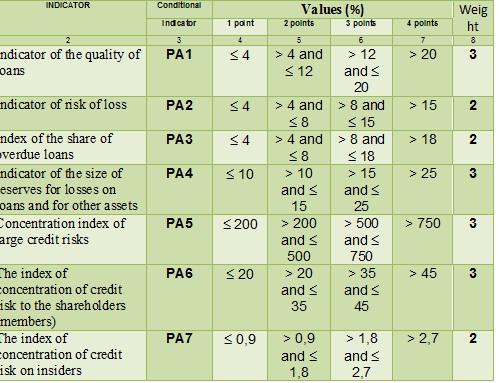

Scoring and weighting of indicators of performance assessment of assets valuation Central Bank of Russia, translated to English by Alexander Shemetev ftablepa.jpg:500x383, 85k |

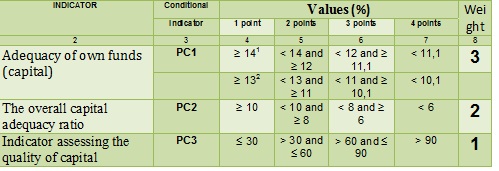

Scoring and weighting of performance assessment indicators for assessing bank’s capital Alexander Shemetev ftablepc.jpg:499x171, 39k |

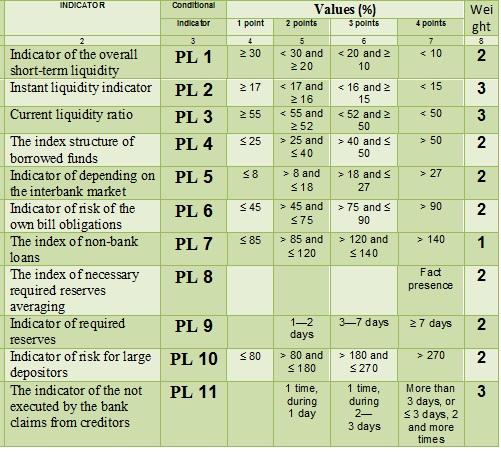

Scoring and weighting of performance assessment indicators to measure the liquidity Central Bank of Russia, translated to English by Alexander Shemetev ftablepl.jpg:501x452, 114k |

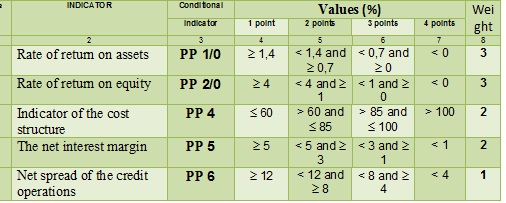

Scoring and weighting of performance assessment indicators to measure the profitability of commercial bank Central Bank of Russia, translated to English by Alexander Shemetev ftablepp.jpg:506x203, 50k |

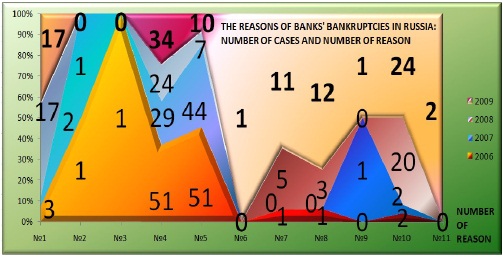

Information about the bankruptcy of banks in Russia January 1, 2006 to January 1, 2010 Alexander Shemetev gr1.jpg:503x259, 54k |

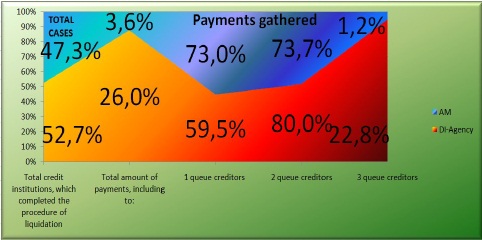

Completion of bankruptcy proceedings of banks in Russia from January 1, 2006 till January 1, 2010 Alexander Shemetev gr2.jpg:482x240, 40k |

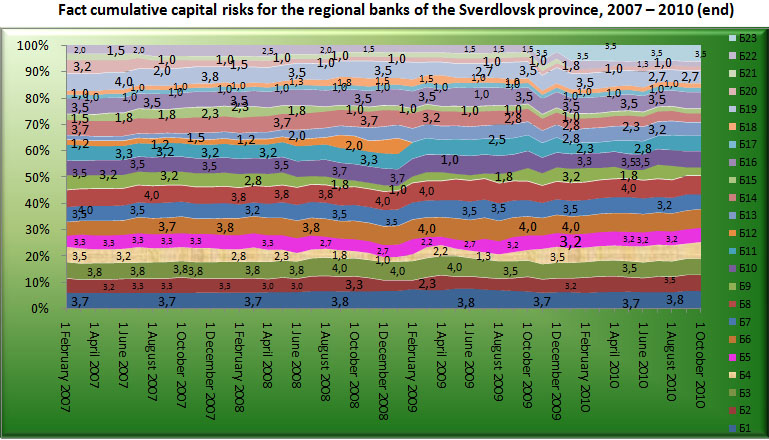

Fact cumulative capital risk for the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev kapital.jpg:769x440, 165k |

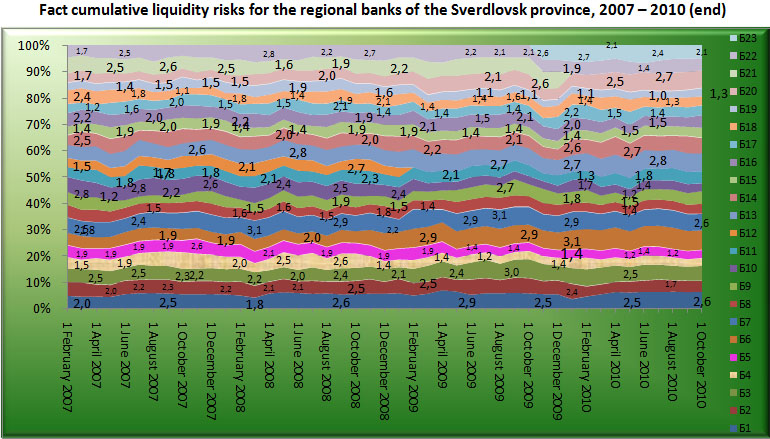

Fact cumulative liquidity risk for the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev likwidnostx.jpg:770x439, 170k |

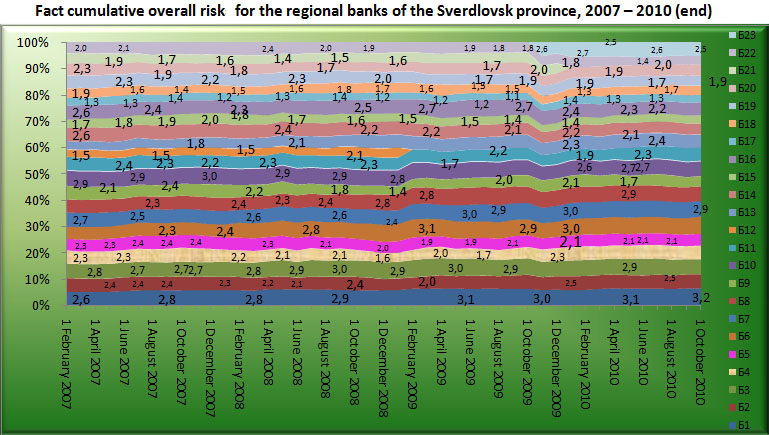

Fact cumulative overall risk for the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev obshij.jpg:769x435, 160k |

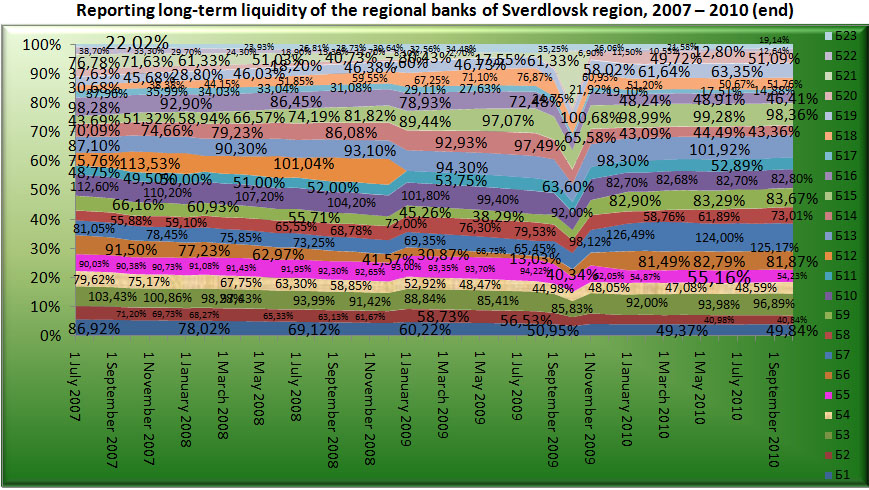

Reporting long-term liquidity of the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev otchdolgsrochlikw.jpg:869x490, 262k |

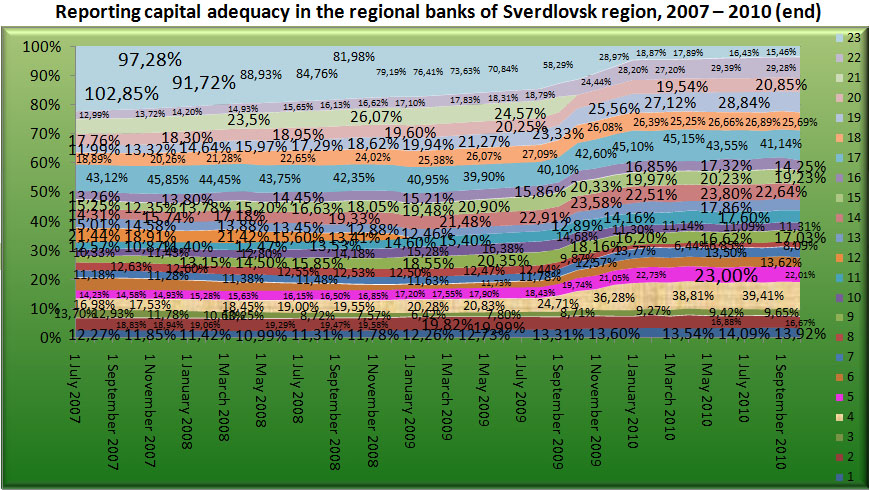

Reporting capital adequacy in the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev otchdostkap.jpg:869x490, 263k |

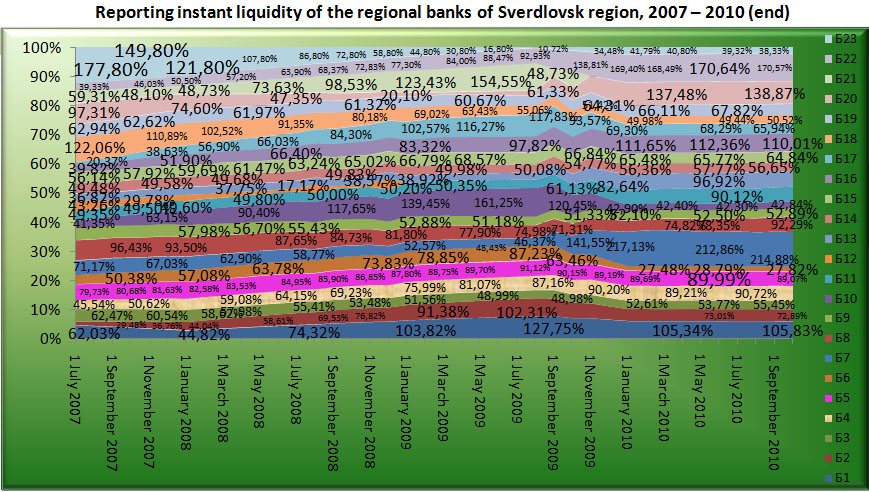

Reporting instant liquidity of the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev otchmgnlikw.jpg:869x492, 275k |

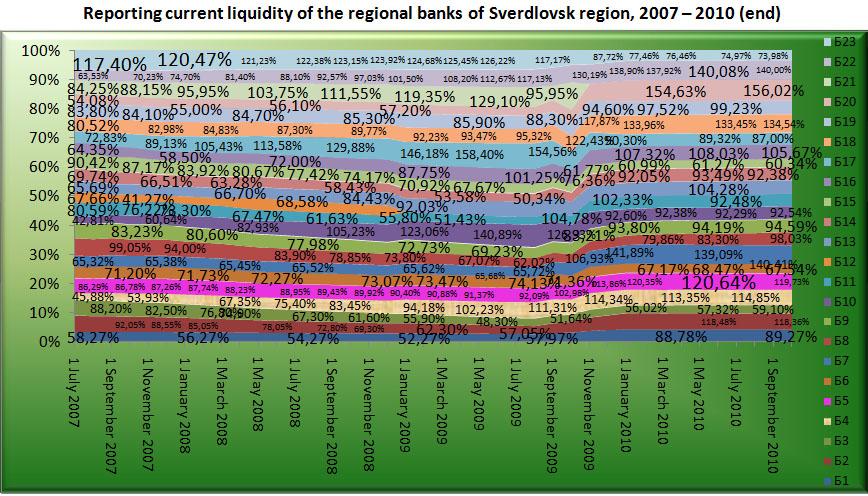

Reporting current liquidity of the Regional banks of Sverdlovsk region, 2007-2010 (end) Alexander Shemetev otchteklikw.jpg:868x496, 278k |

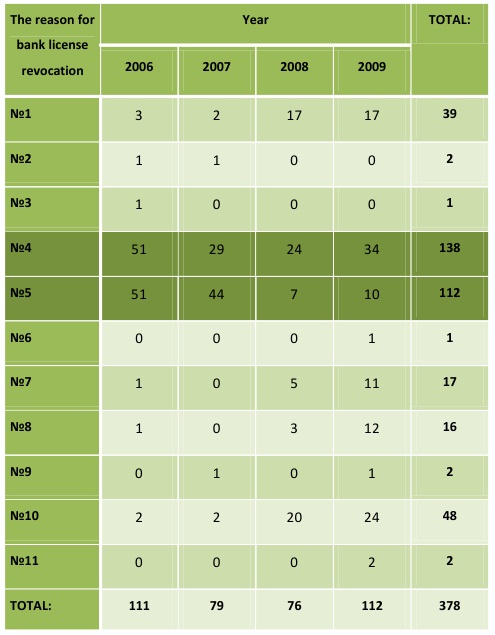

Information about the bankruptcy of banks in Russia January 1, 2006 to January 1, 2010 Alexander Shemetev ta1.jpg:495x635, 64k |

Completion of bankruptcy proceedings of banks in Russia from January 1, 2006 till January 1, 2010 Alexander Shemetev ta2.jpg:452x157, 32k |